7 Easy Facts About Best Bankruptcy Attorney Tulsa Explained

Table of ContentsChapter 7 - Bankruptcy Basics Things To Know Before You BuyA Biased View of Best Bankruptcy Attorney TulsaThe Basic Principles Of Tulsa Bankruptcy Attorney The 45-Second Trick For Chapter 7 Vs Chapter 13 BankruptcyIndicators on Chapter 13 Bankruptcy Lawyer Tulsa You Need To Know

The stats for the other major type, Chapter 13, are also worse for pro se filers. (We break down the differences between both enters deepness below.) Suffice it to say, talk with a legal representative or 2 near you who's experienced with bankruptcy regulation. Below are a few sources to locate them: It's understandable that you may be hesitant to pay for an attorney when you're already under substantial monetary pressure.Many attorneys also offer totally free appointments or email Q&A s. Benefit from that. (The charitable application Upsolve can aid you find complimentary appointments, resources and legal assistance absolutely free.) Ask if bankruptcy is without a doubt the best option for your scenario and whether they think you'll certify. Before you pay to submit bankruptcy kinds and blemish your credit scores record for as much as one decade, inspect to see if you have any kind of viable alternatives like debt arrangement or charitable credit score therapy.

Advertisement Currently that you have actually determined bankruptcy is certainly the best training course of activity and you with any luck cleared it with a lawyer you'll require to get started on the paperwork. Before you dive right into all the official insolvency kinds, you must get your own papers in order.

5 Easy Facts About Tulsa Bankruptcy Attorney Shown

Later down the line, you'll really need to prove that by disclosing all type of information regarding your financial events. Here's a basic checklist of what you'll need when driving ahead: Determining files like your driver's certificate and Social Safety card Tax obligation returns (up to the previous 4 years) Evidence of earnings (pay stubs, W-2s, freelance revenues, earnings from possessions in addition to any kind of revenue from federal government advantages) Bank declarations and/or pension declarations Proof of worth of your possessions, such as automobile and genuine estate valuation.

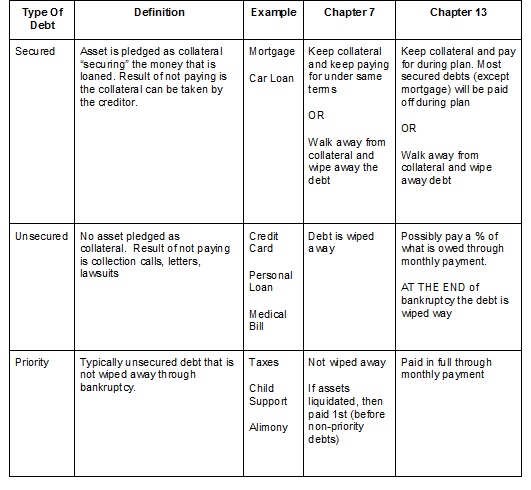

You'll wish to comprehend what type of financial obligation you're trying to settle. Financial debts like youngster support, alimony and particular tax financial debts can't be released (and insolvency can not halt wage garnishment relevant to those debts). Student loan financial debt, on the other hand, is possible to discharge, however note that it is hard to do so (Tulsa bankruptcy lawyer).

You'll wish to comprehend what type of financial obligation you're trying to settle. Financial debts like youngster support, alimony and particular tax financial debts can't be released (and insolvency can not halt wage garnishment relevant to those debts). Student loan financial debt, on the other hand, is possible to discharge, however note that it is hard to do so (Tulsa bankruptcy lawyer).If your earnings is too high, you have one more choice: Phase 13. This alternative takes longer to settle your financial obligations because it calls for a long-term settlement plan usually three to five years prior to a few of your remaining financial obligations are wiped away. The declaring process is also a whole lot extra complicated than Chapter 7.

Some Known Factual Statements About Bankruptcy Law Firm Tulsa Ok

A Chapter 7 bankruptcy stays on your credit scores record for 10 years, whereas a Phase 13 insolvency diminishes after seven. Both have enduring effect on your credit rating, and any kind of new financial obligation you get will likely feature higher passion prices. Before you submit your bankruptcy types, you have to initially finish an obligatory program from a credit scores counseling agency that has actually been approved by the Department of Justice (with the notable exception of filers in Alabama or North Carolina).

The program can be finished online, in person or over the phone. Courses typically set you back between $15 and $50. You must complete the program within 180 days of declare bankruptcy (Tulsa OK bankruptcy attorney). Use the Department of Justice's website to locate a program. If you stay in Alabama or North Carolina, you have to select and finish a program from a checklist of independently approved providers in your state.

All about Best Bankruptcy Attorney Tulsa

An attorney will generally handle this for you. If you're filing by yourself, know that there are regarding 90 different bankruptcy areas. Check that you're submitting with the right one based upon where you live. If your permanent house has moved within 180 days of loading, you need to file in the district where you lived the better part of that 180-day period.

Normally, your insolvency like this lawyer will certainly function with the trustee, however you might need to send the individual files such as pay stubs, income tax return, and savings account and bank card statements directly. The trustee that was just appointed to your instance will quickly establish an obligatory conference with you, called the "341 meeting" since it's a need of Area 341 of the U.S

You will require to provide a timely listing of what qualifies as an exception. Exceptions might relate to non-luxury, main cars; needed home goods; and home equity (though these exemptions policies can vary commonly by state). Any residential property outside the checklist of exceptions is taken into consideration nonexempt, and if you don't give any checklist, after that all your property is thought about nonexempt, i.e.

You will require to provide a timely listing of what qualifies as an exception. Exceptions might relate to non-luxury, main cars; needed home goods; and home equity (though these exemptions policies can vary commonly by state). Any residential property outside the checklist of exceptions is taken into consideration nonexempt, and if you don't give any checklist, after that all your property is thought about nonexempt, i.e.The trustee would not offer your cars to immediately repay the lender. Instead, you would certainly pay your creditors that quantity throughout your repayment plan. A common misconception with insolvency is that once you file, you can stop paying your financial obligations. While bankruptcy can help you clean out numerous of your unsafe financial Discover More obligations, such as past due medical bills or personal finances, you'll desire to maintain paying your monthly payments for protected debts if you want to maintain the residential property.

A Biased View of Tulsa Bankruptcy Filing Assistance

If you go to risk of foreclosure and have actually worn down all various other financial-relief alternatives, then submitting for Phase 13 might delay the foreclosure and assist in saving your home. Ultimately, you will certainly still need the revenue to continue making future home mortgage payments, in addition to settling any late settlements throughout your repayment strategy.

If so, you may be needed to provide extra details. The audit could postpone any financial debt alleviation by a number of weeks. Of training course, if the audit transforms up incorrect information, your situation might be dismissed. All that said, these are relatively rare instances. That you made it this far at the same time is a decent sign a minimum of some of your financial obligations are qualified for discharge.